Is Vat Charged On Food In Restaurants . is there vat on food in restaurants? This is a common question that often arises when dining out. in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. Vat, or value added tax, is a consumption tax applied. • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer.

from www.jagoinvestor.com

This is a common question that often arises when dining out. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. Vat, or value added tax, is a consumption tax applied. is there vat on food in restaurants? the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer.

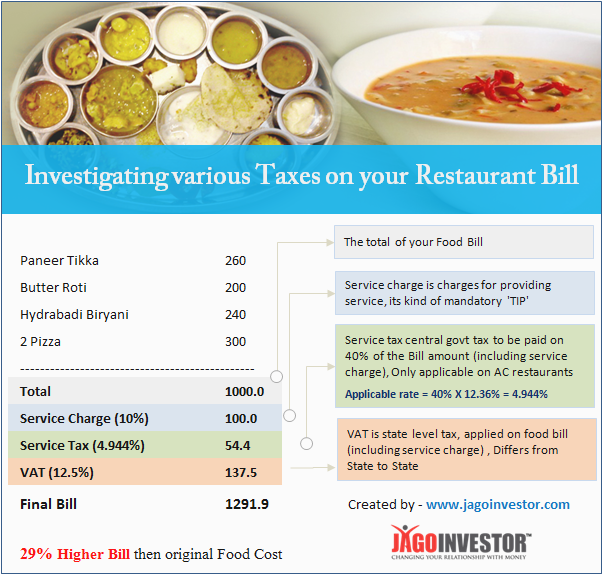

Service Charge, Service Tax and VAT on Restaurant/Hotel Bills

Is Vat Charged On Food In Restaurants • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. is there vat on food in restaurants? This is a common question that often arises when dining out. Vat, or value added tax, is a consumption tax applied. • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills.

From economictimes.indiatimes.com

GST Effect How will your restaurant bill look like post GST? Is Vat Charged On Food In Restaurants Vat, or value added tax, is a consumption tax applied. the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. is there vat on food in restaurants? Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. • a restaurant makes. Is Vat Charged On Food In Restaurants.

From www.jagoinvestor.com

Service Charge, Service Tax and VAT on Restaurant/Hotel Bills Is Vat Charged On Food In Restaurants This is a common question that often arises when dining out. is there vat on food in restaurants? • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to. Is Vat Charged On Food In Restaurants.

From www.leraccountancy.co.uk

VAT on Food and Drinks for Restaurants and Cafes Is Vat Charged On Food In Restaurants in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. This is a common question that often arises when dining out. the vat on the sale of food. Is Vat Charged On Food In Restaurants.

From chacc.co.uk

VAT on Food Future of VAT in Hospitality Industry Is Vat Charged On Food In Restaurants the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. This is a common question that often arises when dining out. in the hotel or food & beverage (“f&b”) industry, businesses often. Is Vat Charged On Food In Restaurants.

From vatcalculatorg.com

Is There VAT on Restaurant Food [Explained] Is Vat Charged On Food In Restaurants is there vat on food in restaurants? Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. in the hotel or food & beverage (“f&b”) industry, businesses often add a service. Is Vat Charged On Food In Restaurants.

From www.taxaccountant.co.uk

VAT on Food Restaurants Takeaways Tax Accountant Is Vat Charged On Food In Restaurants This is a common question that often arises when dining out. in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. Standard rate vat is applied on all food items. Is Vat Charged On Food In Restaurants.

From showme.co.za

VAT zerorated foods South African News Is Vat Charged On Food In Restaurants in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. • a restaurant makes a supply of goods and services when it provides food, drinks and services to. Is Vat Charged On Food In Restaurants.

From www.livemint.com

Eating out and the various taxes that you have to pay Mint Is Vat Charged On Food In Restaurants This is a common question that often arises when dining out. • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. in the hotel or food & beverage (“f&b”) industry,. Is Vat Charged On Food In Restaurants.

From vatcalcuk.com

VAT on Food and Drinks in Restaurants 2024 Is Vat Charged On Food In Restaurants • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is. Is Vat Charged On Food In Restaurants.

From www.boostexcel.com

Restaurant Dining Invoice Template (VAT) Is Vat Charged On Food In Restaurants the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. Vat, or value added tax, is a consumption tax applied. is there vat on food in restaurants? • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. Standard rate vat. Is Vat Charged On Food In Restaurants.

From inews.co.uk

Staff at London restaurant get death threats after antiBrexit message Is Vat Charged On Food In Restaurants Vat, or value added tax, is a consumption tax applied. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. in the hotel or food & beverage (“f&b”) industry, businesses often add. Is Vat Charged On Food In Restaurants.

From markettradenews.com

Hot or cold? VAT regulations for mobile caterers Is Vat Charged On Food In Restaurants in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. This is a common question that often arises when dining out. the vat on the sale. Is Vat Charged On Food In Restaurants.

From www.newsbytesapp.com

You can deny paying service charge at restaurants. Here's why Is Vat Charged On Food In Restaurants Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. Vat, or value added tax, is a consumption tax applied. in the hotel or food & beverage (“f&b”) industry,. Is Vat Charged On Food In Restaurants.

From focusandsomaraccountants.com

VAT On Food Products in UK Focus Somar Audit & Tax Accountants Ltd Is Vat Charged On Food In Restaurants the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their. Is Vat Charged On Food In Restaurants.

From www.businesspost.ie

Restaurants dispute state’s claim that extending Vat rate would cost € Is Vat Charged On Food In Restaurants the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. This. Is Vat Charged On Food In Restaurants.

From rfm-more.co.uk

VAT and food retail What's 'hot' and what's not? VAT advice Is Vat Charged On Food In Restaurants Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which. is there vat on food in restaurants? in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. the vat on the sale of food items (starters, dishes,. Is Vat Charged On Food In Restaurants.

From www.reddit.com

Order number on this receipt is the same as the cost of the food r Is Vat Charged On Food In Restaurants is there vat on food in restaurants? • a restaurant makes a supply of goods and services when it provides food, drinks and services to a customer. Vat, or value added tax, is a consumption tax applied. This is a common question that often arises when dining out. Standard rate vat is applied on all food items consumed. Is Vat Charged On Food In Restaurants.

From myrepublica.nagariknetwork.com

Restaurants reluctant to remove service charge from customers’ bills Is Vat Charged On Food In Restaurants the vat on the sale of food items (starters, dishes, desserts, etc.) for immediate consumption is 10%. in the hotel or food & beverage (“f&b”) industry, businesses often add a service charge, typically at 10%, to their bills. • a restaurant makes a supply of goods and services when it provides food, drinks and services to a. Is Vat Charged On Food In Restaurants.